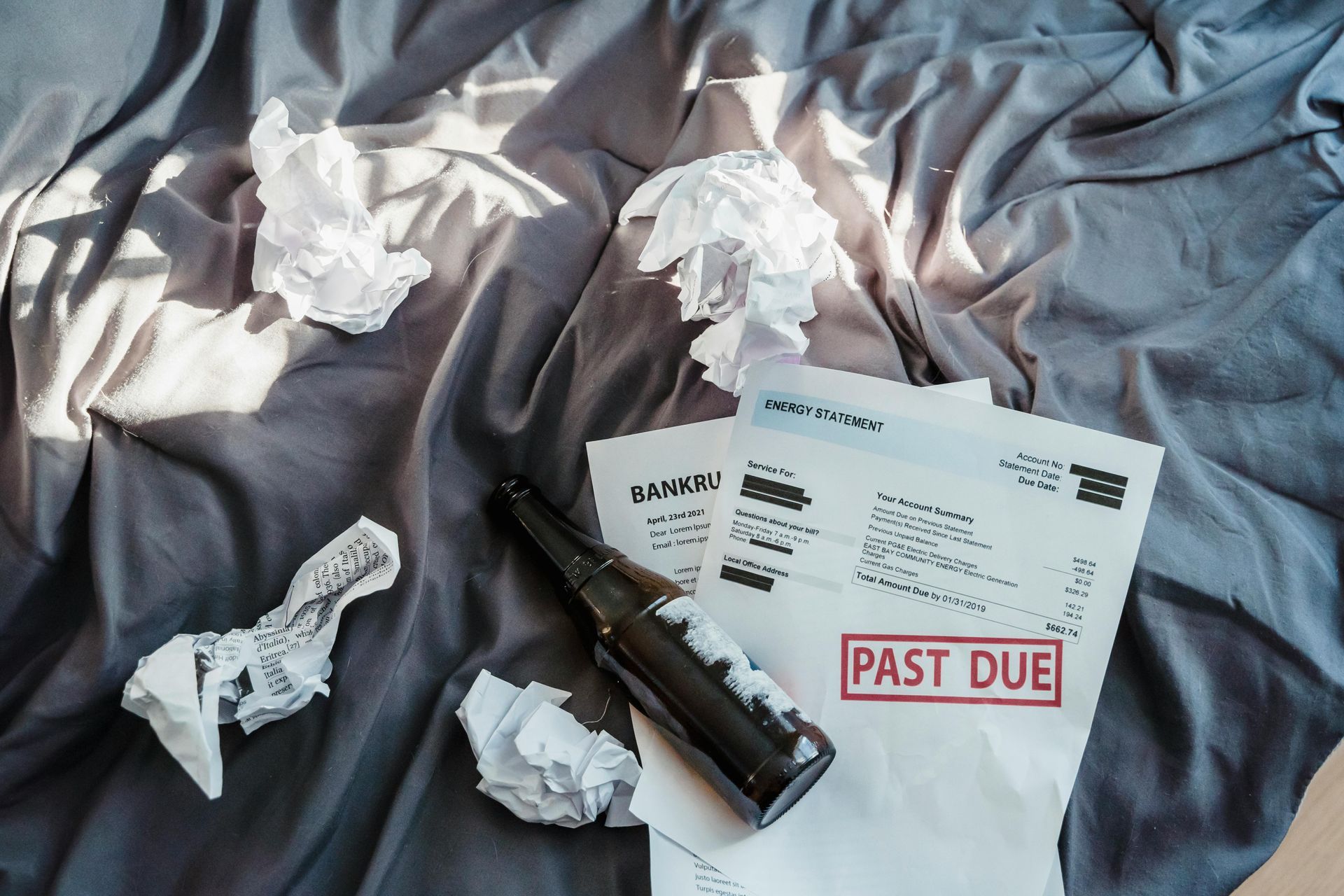

How extensive is credit card debt for college students?

College students are facing increasing levels of credit card debt. On average, students carry over $3,280 in credit card balances. According to a 2024 study, roughly 65% of students have some form of credit card debt.

This figure surpasses the amount of student loan debt, which also causes significant worry. In fact, 53% of students consider credit card debt their most concerning financial issue, compared to 44% who are more worried about student loans.

With rising tuition costs and other financial pressures, managing credit card debt has become a critical issue for many students.

How students use their credit cards

On average, college students report getting their first credit card just shy of their 20th birthday. For some, it’s the first step in building their credit. However, 57% of students participating in the survey reported using plastic only for emergencies.

For those who use them regularly, here are some of the most common purchases:

- Online shopping (70.1%)

- Dining (50%)

- Gas (44.4%)

- Groceries (40.6%)

- Travel (35.2%)

These categories show that students use their credit cards for both essential and nonessential purchases. Understanding these spending habits is critical for developing better financial management strategies.

Most common credit card mistakes

Students often make several errors that lead to unwieldy credit card debt. Here are 10 common mistakes:

- Only paying the minimum amount

- Missing a payment

- Not keeping receipts

- Not reading credit card statements

- Overusing them

- Habitually paying late

- Taking cash advances

- Transferring balances to avoid payments

- Buying expensive items

- Applying for unnecessary cards

To avoid these traps, students should develop good habits such as paying more than the minimum amount and making timely payments. Sticking to a budget and monitoring spending can also help manage credit card debt effectively.

Striving for financial independence

The study found that most students manage their credit card debt effectively, despite facing an increasing list of financial stressors. This includes an uptick in credit card usage compared to before the COVID-19 pandemic.

For those who struggle financially, seeking advice from a bankruptcy attorney can provide options to manage overwhelming credit card debt, which may include filing for bankruptcy protection. A knowledgeable lawyer can help students achieve financial security as they begin their next phase of life.