College students and the credit card conundrum: Tips for wise use

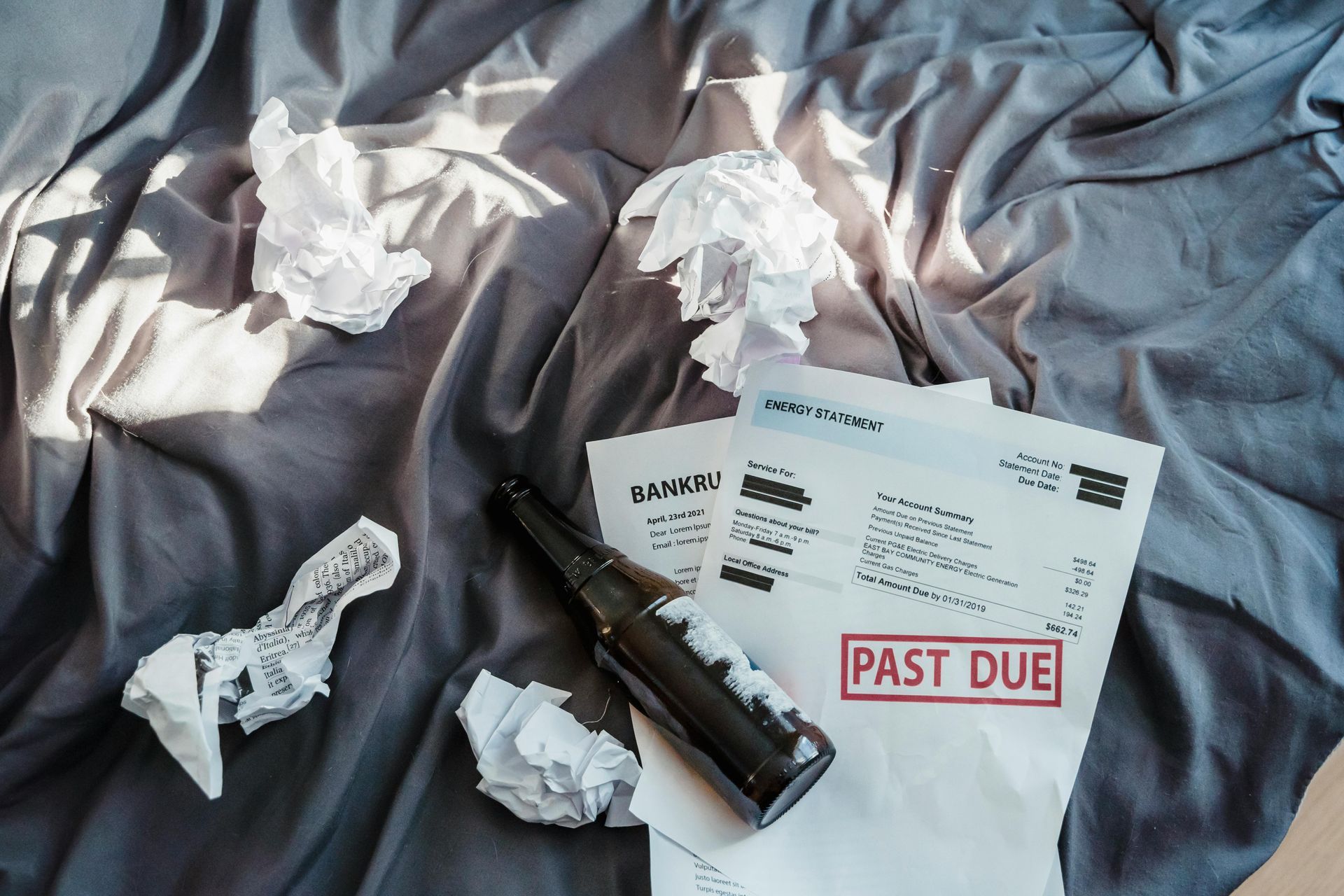

Picture this: You are a college freshman, standing at the crossroads of newfound independence and financial responsibility. Your wallet holds a shiny credit card — the gateway to convenience but also potential debt. Before you swipe, pause. This plastic rectangle is not just a payment tool; it is a financial compass that can lead you astray or guide you toward stability.

But how do you make sure you use this tool for financial stability and not as a pathway to unmanageable debt? The following tips can help.

1. Avoid overspending

The allure of credit cards lies in their convenience. With a simple swipe, students can buy without feeling the impact on their savings. However, this distance from immediate financial consequences can lead to overspending. Try not to spend more than you can repay to avoid this temptation. Do not see use of a credit card as a way to spend money you do not yet have. This can result in bad spending habits and a mindset that carries into adulthood, leading to unmanageable debt.

2. Watch out for high rates, minimum payments, hidden charges, and misleading rewards

Student credit cards often come with very high interest rates. Failing to pay the entire balance each month can lead to additional interest charges. Over time, this can snowball into massive debt that is tough to escape. Credit card companies try to refute this thought by only requiring minimal monthly payments. While it seems beneficial for a student to only worry about paying the minimum, it means the principal balance remains, prolonging debt and increasing interest payments.

It is also important to beware of hidden fees. Examples can include annual fees and late payment charges. Students, often unaware of these costs, may end up paying much more than anticipated.

Credit card companies are also notorious for trying to entice students with rewards, cash back, or sign-up bonuses. But the costs (high interest rates and potential fees) often outweigh the benefits. It is often best to skip that free t-shirt or mug that comes with signing up for a new card.

3. Educate yourself about the impact on your credit score

Mismanagement of credit cards can severely impact credit scores. Late payments, high balances, and maxing out credit limits damage credit history. A low credit score affects future loans, mortgages, and even job prospects.

Remember, college is a time to learn and grow, both academically and financially. Make informed choices, and tread carefully with credit cards to help build, not ruin, your future financial stability.